Partnerships in California can save large by exploiting state and government corporate tax breaks. These can incorporate government recruiting credits, alongside big business zone credits that may incorporate vehicle charge motivations for qualifying vehicles and trucks. Sadly, numerous organizations are uninformed of these motivations, which can dispense with an enormous segment of their corporate expense. Nonetheless, right now is an ideal opportunity, before your organization records its government forms, to check in with a guaranteed public bookkeeper with aptitude in corporate assessment arranging and figure out which corporate duty might be accessible for your organization’s utilization. Employing tax breaks are given to organizations by both the territory of California just as the government. The government program is called WOTC, or the Work Opportunity Tax Credit. Your company can procure these government recruiting credits when you utilize individuals from specific gatherings.

These can incorporate qualified incapacitated veterans and veterans who are qualified for food stamps, the individuals who were laid off or are being undermined with a lay off, individuals of Native American or Pacific Islander plunge, certain late spring youth recruits and ex-criminals, and the individuals who are qualified for or get SSI, brief help for destitute families or food stamps. At the point when your partnership enlists individuals from any of these perceived gatherings, your organization may then get government employing credits going from $2,400 to $4,800, situated partially on the pay they procure just as to which bunch they have a place. Commonly, these government recruiting credits go unused basically in light of the fact that organizations do not understand that they meet all requirements for them, so ask a CPA acquainted with these tax breaks how they may apply to your duties.

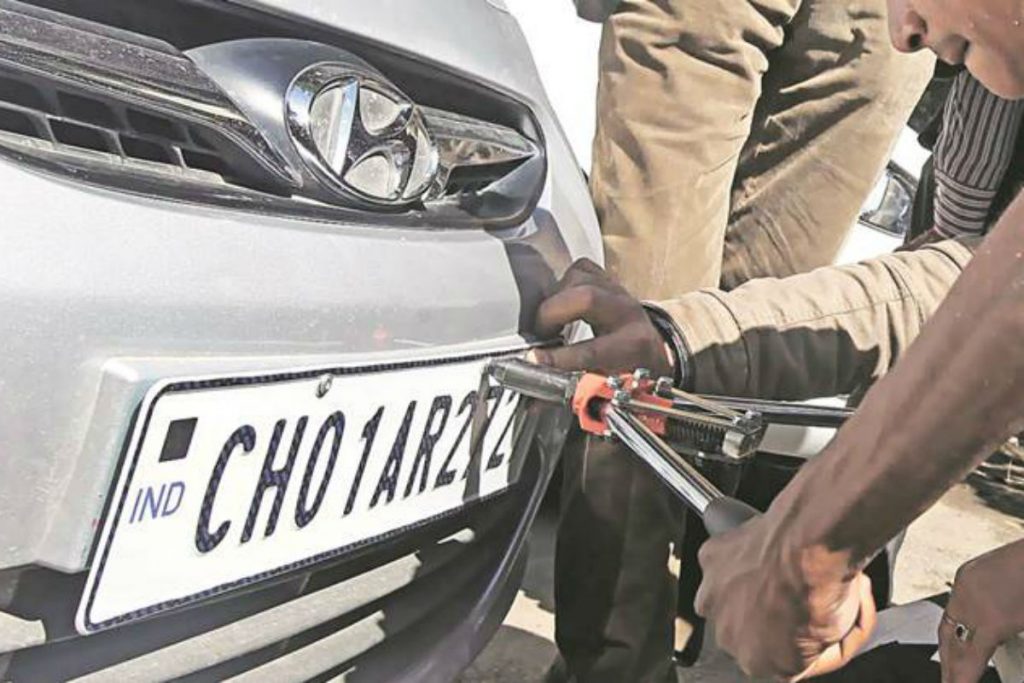

Notwithstanding government employing credits, your enterprise may likewise be qualified for state-based recruiting tax breaks. These can be associated with big business zone credits also. California has 42 endeavor zones, where organizations are urged by the state to settle in and recruit individuals using these state tax breaks. Representatives of your organization inside any of the previously mentioned gatherings may likewise qualify your enterprise to get up to an extra $13,000 per worker every year and try the vrt calculator. Other corporate credits might be found in vehicle charge motivators. At the point when your organization in an undertaking zone does the change to half breed or diesel vehicles, you can procure tax breaks for doing your part to secure the climate at work. In addition to the fact that they offer exceptional educational cost they give data on driving exercises in Leeds by composing articles to illuminate all their student drivers on activities, clues and tips both when finishing their driving assessment.